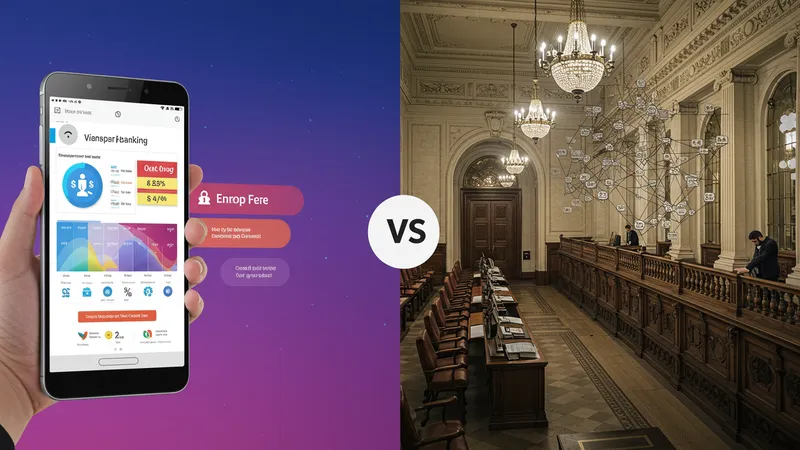

Imagine opening a USD bank account without stepping outside your door. Sounds impossible? It’s not. From Secret VPNs to innovative fintech platforms, the game of banking is changing drastically every day. But why does this matter now more than ever?

With global transactions increasingly paramount, the ability to effortlessly manage foreign currency accounts is essential for savvy investors and digital nomads. The race to create seamless cross-border banking experiences is heating up, and those who don't adapt could get left behind.

Believe it or not, virtual USD accounts aren't just for tech-savvy millennials or jet-setting entrepreneurs. They’re becoming the standard for flexibility in this era of globalization. Beyond the convenience of never setting foot in a physical bank, these accounts eliminate prohibitive international bank fees and currency conversion traps. But that’s not even the wildest part…

You might be wondering about the safety and legitimacy of these virtual banking solutions. The interesting twist is, some banks without physical branches offer even higher security and better interest rates than traditional ones. These virtual giants are leveraging cutting-edge technology to outperform conventional banks on almost all fronts. However, what happens next shocked even the experts…

Opening a virtual USD account means saying goodbye to long wait times and cumbersome paperwork. You can manage it from the comfort of your home, adjusting strategies on the fly. Many digital platforms offer stellar exchange rates, unmatched by brick-and-mortar banks, making a marked difference in your savings account. But there’s one more twist…

The ability to access multiple currencies simultaneously without hefty conversion fees allows users to diversify their investments in real-time. This makes virtual accounts revolutionary for avid investors keen on maximizing returns from fluctuating currency markets. What you read next might change how you see this forever.

Thanks to banking innovation, virtual accounts are equipped with digital tools that track spending and report detailed analytics right at your fingertips. Beyond personalized budgeting, these tools often include fraud detection algorithms that enhance security more robustly than standard banks. Yet, the story doesn’t end there…

Fintech companies are continually innovating, adding more beneficiary features—some even provide financial advisors to assist in wealth management. This level of service was once exclusive to the wealthy but is now readily available. Stay with us as the reality of virtual banking unfolds with each page.

The primary concern about virtual USD accounts is security, but here's a surprise: digital banks often deploy advanced encryption and biometric security systems more efficient than their physical counterparts. Such robust security frameworks provide a foolproof virtual vault for your savings. But hang on, it gets even better...

These cutting-edge security features significantly prevent cyber threats, offering peace of mind to clients transacting large sums internationally. Many platforms employ AI algorithms to preemptively detect suspicious activities far more accurately than traditional bank fraud teams. The implications might just revolutionize how secure you feel about digital finance.

A top perk is the real-time transaction notifications that traditional banks typically offer as an added paid feature. With virtual banking, you remain informed and critical issues are addressed rapidly. But here’s the kicker: not many recognize how this disrupts the dynamics of power in banking.

The transparency offered by these platforms is commendable. They’re subject to regulatory frameworks similar to traditional banks but do not carry the burden of maintaining physical branches. This means efficient resource allocation to technology and customer service. What you read next will be a real eye-opener.

Breaking down barriers, setting up a virtual USD account is a breeze compared to traditional banks. The process is streamlined through a straightforward eKYC (Electronic Know Your Customer) procedure, right from your smartphone or PC. Say goodbye to cumbersome in-person verifications. Ready to get started?

Begin with choosing a reliable platform that fits your needs. Evaluate factors like exchange rates, withdrawal fees, and additional tools provided. These little nuances can make a significant impact in the long run. But don't rush just yet; there’s more to the tale.

Input your details, upload necessary identification documents, and you’re set to go. Many platforms approve accounts in mere hours compared to several days in conventional banks. The speed and finesse of this process redefine efficiency in banking, but we still haven’t covered all bases...

Once set up, you can create spend cards, access analytics tools, and seamlessly integrate with other financial platforms, making it easier to manage money across borders. This power in your palm might just redefine how you handle your financial relationships. Want more insights? Keep reading!

Having a virtual USD account grants you instant access to global markets without leaving your home country. From buying stocks in the US to investing in global startups, possibilities are endless. The changes in how we invest are unprecedented, and the big players are taking notice. But what’s the secret sauce?

Accessibility has never been this easy; connect your account to platforms like Stripe or PayPal for seamless financial transactions with minimal fees. Many entrepreneurs leverage virtual accounts to manage international subsidiaries or freelancers. With no borders holding them back, their ventures skyrocket.

In the world of e-commerce, this attachment to international platforms gives an edge to businesses, sparking economic growth across borders. Diversifying globally without the need for physical presence cuts down both risk and cost, and might surprise you with the opportunities you uncover.

But wait, there's another layer. These platforms often offer innovative tools to bridge language and legal barriers, making cross-border investments more achievable than ever before. This unexpected capability is reshaping the business landscape. Read on to see how this evolution continues...

The birth of virtual USD accounts is not just about convenience—it's fueled by a profound shift in financial power. Fintech startups are leveraging technology to bypass traditional economic powerhouses, offering products tailored to individual needs. But there's a twist in this tale...

By democratizing access to financial services, these platforms empower individuals with more control over their financial futures. The accessibility they provide can foster a more equitable global economy, benefiting those without prior access to traditional banking fronts. But the journey doesn’t end here.

Virtual banks challenge old monopolies, emphasizing inclusive banking. Users notice an increased social push to embrace this as a standard, with unprecedented developments like crypto banking integrated into everyday accounts. This critical juncture could potentially disrupt future banking norms.

Fintech’s rapid growth indicates one thing: traditional banks need to innovate urgently or risk obsolescence. Yet, the question remains—is this evolution sustainable? And at what cost will these rapid transformations come? The answers lie just beyond this text.

Picture a financial world without borders, where USD flows seamlessly across continents with negligible friction. Virtual banking enables a global citizen's dream, but did you realize the dormant potential it unlocks? The benefits are boundless.

For the first time, freelancers and businesses in developing regions have equal access to foreign currency markets, leveling the playing field. As trust in virtual banking grows, economies of scale blossom, beckoning more to join the digital financial ecosystem.

The opportunities are staggering. The enhanced cash flow dynamics promise exponential growth for small businesses previously hindered by logistical hurdles. This financial Renaissance, however, brings its own set of challenges and unknowns.

Virtual banking's rise is integral to socio-economic development, not just a transient phase. This journey from digital convenience to financial revolution is steering our future economy toward uncharted waters. Want to explore what's on the horizon? Let’s dive deeper together!

Looking through the crystal ball, virtual banking is only set to grow exponentially, morphing into platforms more intuitive and interconnected than ever. Expect integration with avant-garde tech like AI-driven banking assistants. You won’t believe what’s next.

Think seamless cryptocurrency handling integrated within your virtual bank, enabling transactions at the speed of thought and opening crypto markets to the masses. These trends promise to transform how we engage with money. So, what's the catch?

Emerging technologies promise heightened personalization, predicting your financial needs before you even ask. This automation, however, demands stringent data privacy measures to ensure trust. The stakes in maintaining cybersecurity rise sky-high.

The next decade could redefine global financial relationships, shifting economies in unforeseen dynamics, all directed by virtual finances. This wave of change isn't without its pitfalls, promising thrilling yet daunting financial adventures ahead. Ready for what's next?

With multiple virtual USD account platforms to choose from, selecting the right one is crucial. Prioritize understanding your personal or business needs first. There’s a surprising number of factors at play, giving you much to ponder.

Consider aspects like user-friendliness, transaction costs, and reputation. Researching user reviews and seeking expert opinions can demystify your final decision. But remember, there's more than meets the eye in making the best choice.

Additionally, watch out for features that align with your goals, whether it’s investments, savings, or international transacting. A platform offering robust customer support can tip the scales significantly. This is a choice that deserves scrutiny.

With virtual accounts blurring borders, check laws and compliance in your operational jurisdictions. Safeguarding your interests ensures peace of mind as you delve deeper into this financial labyrinth. The journey of decision-making now rests in your hands.

Real-life cases scream success—from digital nomads managing expenses abroad effortlessly to small startups dominating new markets unencumbered by currency limits. And yes, there’s something to learn from every story.

Big brands have also reaped massive benefits, catalyzing growth by leveraging virtual accounts to streamline international payrolls. The beauty? Enhanced liquidity and reduced overheads when the best practices are adopted. But not every story paints a rosy picture.

Challenges like ensuring regulatory adherence and maintaining cross-border partnerships pop up as hurdles. Yet, the innovative drive behind virtual banking ensures most obstacles are but stepping stones. New opportunities unfurl with every adjustment.

Success stories across digital platforms show how ambitious needs merge with practical solutions, compelling us to rethink conventional finance strategies. What’s next for the bold dreamers ready to change their financial narrative? Continue reading to uncover their path.

Starting strong is not enough—staying secure and informed is key in managing virtual USD accounts. Challenges like identity theft, fraudulent platforms, and regulatory compliance loom overhead. But stay focused, because solutions persist.

Engage with platforms verified by credible financial authorities, upholding international safety standards. Reviews and expert advice assist in minimizing risks when seeking the right service provider. Hidden surprises can't tilt the balance if cautiously approached.

A wave of regulation in virtual finance demands users remain informed about evolving compliance laws. Timely advice from financial professionals can help bridge understanding gaps. Mastery in this area translates into a robust financial strategy.

By anticipating pitfalls and proactively troubleshooting, the virtual financial realm can become a fortress of opportunity. Maintain vigilance to prevent mishaps and embrace the learning journey. This wisdom transects your path to financial freedom as we dive deeper into the story.

The remote work revolution has opened the sky for virtual USD accounts, serving as a lifeline in a globalized work environment. Remote teams thrive, managing international operations with ease. But there’s more happening than meets the eye.

Work-from-anywhere policies underscore the need for seamless digital transactions. Gone are the pains of lengthy bank transfers, replaced by instant payments connecting continents. This flexibility feeds the thirst for more dynamic work models.

Remote companies leverage virtual platforms for immediate pay cycles, minimizing delays and enhancing employee satisfaction. The ripple effect empowers a borderless workforce, streamlining operations worldwide. Where is this leading us next?

The future beckons an increase in productivity and efficiency, thanks to virtual banking solutions. As companies lean more toward remote models, the need for digital financial infrastructure swells. Understanding this evolution is key to future-proof your career or business. Moving on, let’s explore what tomorrow holds.

Understanding cost structures is crucial for anyone considering virtual bank accounts. You’d be surprised to learn how fees stack up against traditional banks, fundamentally altering perceptions. Curious what we uncovered?

Traditionally, hard-to-understand fees slip into financial services unnoticed. Virtual platforms, on the other hand, offer transparent costs, enabling users to manage withdrawals and conversions with clarity. But the devil is in the details...

Maintaining lower operational costs allows virtual banks to offer competitive rates and convert savings into user benefits. This makes them an attractive alternative for savvy consumers. The cost-benefit ratio may prompt a rethink of your financial strategies.

While pricing structures from digital banks are typically attractive, it's vital to compare hidden fees and long-term conditions to make informed choices. Diving deep into the numbers reveals more, and grasping these financial efficiencies may change your strategies forever.

In a world conscious of environmental responsibility, switching to virtual banking presents a revolutionary green promise. By eliminating infrastructure-heavy traditional banking, the ecological footprint shrinks remarkably. But, there’s an unexpected twist.

The reduced reliance on paper, lower energy consumption, and eliminated need for physical storage translate into substantial eco-friendly benefits. Digital transactions also mean fewer resources wasted—a commendable stride toward greener banking.

Environmental sustainability aligns with reduced overheads, reflecting positively on a company's corporate responsibility image. These green advantages can foster significant competitive edges, but does this make virtual banking a win-win solution?

The shift towards a sustainable future sees the banking sector innovating eco-friendly solutions at a rapid pace. Curious how these green gains play out across financial landscapes? The exploration continues with the next insights.

As we unravel the powerful story of virtual USD accounts, it's clear they've rewritten the rules of global finance, challenging norms and reinventing possibilities. This financial evolution demands attention as technology and banking converge like never before. The journey into this digital realm is an unmissable chapter for your economic roadmap.

The emergence of virtual banking signifies more than a trend—it's a cornerstone of future financial realities. Share this exploration with others and dive deeper into the digital finance revolution. Whether for personal empowerment or business innovation, the time to act is now, before the world races ahead.